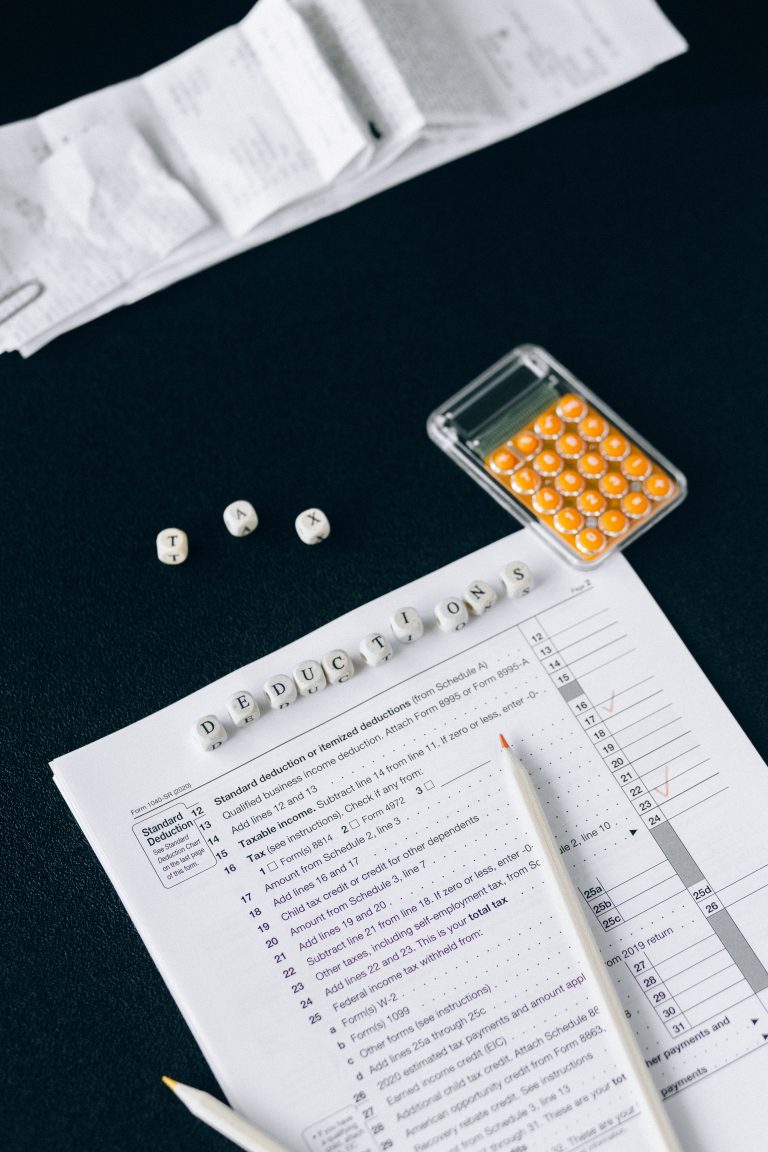

Income Tax Calculator for FY 2023-24 (AY 2024-25) by www.taxlab11.com

Income Tax Calculator for FY 2023-24 (AY 2024-25) for New tax regime as well old tax regime.

A Laboratory of Tax Calculation in India

A Laboratory of Tax Calculation in India